Vista Gold – 9.4 Million Ounces Of Aussie Gold Being Further Derisked And Optimized In The Upcoming Revised Feasibility Study

Fred Earnest, President and CEO of Vista Gold Corp. (NYSE American and TSX: VGZ), joins me for comprehensive company overview of the upcoming Feasibility Study at their Mt Todd gold project; a ready-to-build development-stage gold deposit located in the Tier-1 mining jurisdiction of Northern Territory, Australia.

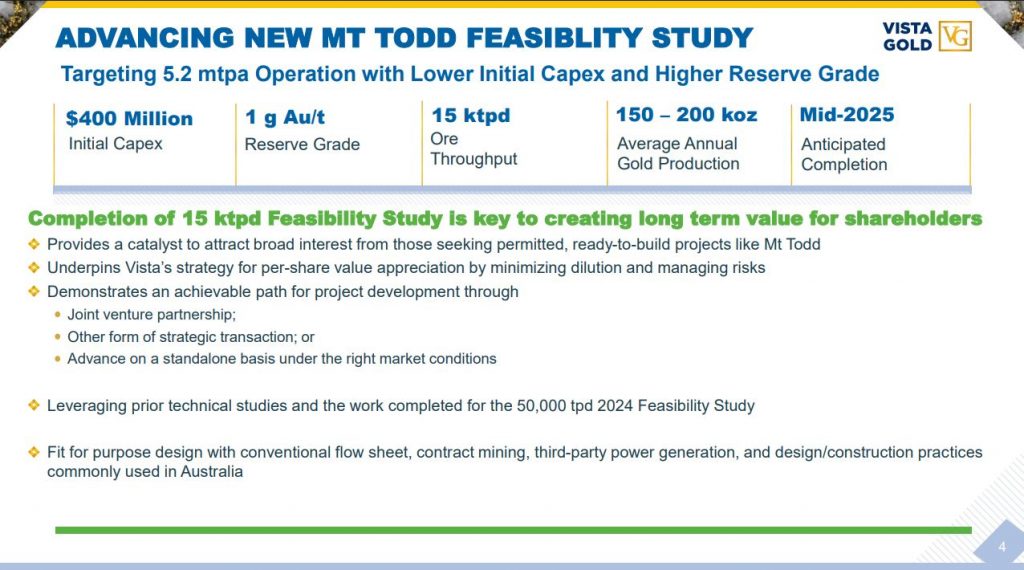

Fred reviews the 9.4 million ounces of gold resources in all categories, and that the resource block model has been updated to incorporate data from the Company’s 2020-2022 and 2024 drilling programs and is being used as the basis for the new mine plan in the upcoming updated feasibility study. This new study aims to increase the reserve grade to 1 gram gold per tonne by applying a higher cut-off grade, and will also incorporate mine scheduling optimization strategies that prioritize higher grade ore during the early years of operation.

The Company is continuing to advance their revised 15,000 tonne per day (tpd) Mt Todd Feasibility Study, and it will differ from the previously modeled 50,000 tonne per day scenario, aiming to reduce initial capex by 60% to $400 million, while averaging annual gold production of 150,000 to 200,000 ounces. Guidance is for delivering the new study by mid-2025 in July. This Feasibility Study will leverage prior technical studies, preserve the potential for future expansion, and demonstrate the opportunity for Mt Todd to deliver attractive economic returns with a smaller initial capital investment.

Fred walks us through how the Mt Todd Project offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated economic feasibility. All major environmental and operating permits necessary to initiate development of Mt Todd are in place.

If you have questions for Fred regarding Vista Gold, then please email those into me at Shad@kereport.com.

Click here to follow the latest news from Vista Gold Corp

.

.

I have owned VZG for 15 years or more and am in the red now, but hope to get into the black one day.

Why doesn’t a major miner buy VZG if it is a good thing? It is big enough to make a difference to GFI or AU or Barrick or a Chinese company? Isn’t this the deposit that put Pegasus into bankruptcy?